Timing your rent payments to ensure that the funds land in the right account on time isn't rocket science, but it can sometimes be a little tricky to get right when starting a new rental arrangement.

If your rent isn't paid by the due date, it's considered as 'rent arrears' which is a breach of your residential tenancy agreement. Unfortunately, this can involve immediate and/or future consequences for you.

You wouldn't want to get in the bad books of your landlord or property manager, or put your tenancy at risk, therefore it's definitely best that you do your best to avoid rent arrears.

Don't worry, once you've figured out what arrangement will work best for you, then you can simply automate your rent payments on a schedule. RentPay lets you pay your way for a stress-free, set-and-forget experience.

We've outlined five simple steps to help set you up for success.

Double-check the rent payment date in your residential tenancy agreement. Your agreement will specify how much rent you need to pay, the lease start date, and when you'll need to make rent payments. The frequency of rent payments are usually weekly, fortnightly or monthly.

We also recommend reading all the fine print to fully understand the terms and conditions of your new arrangement, so that you're completely aware of what you're getting into. It's good to know what happens when a rent payment is late, whether there are any fees for late payments or unsuccessful transactions, etc.

If something doesn't make sense in your lease agreement or you'd like to negotiate an amendment (e.g. rent due dates, frequency of rent payments, etc.), then contact your landlord or property manager to discuss.

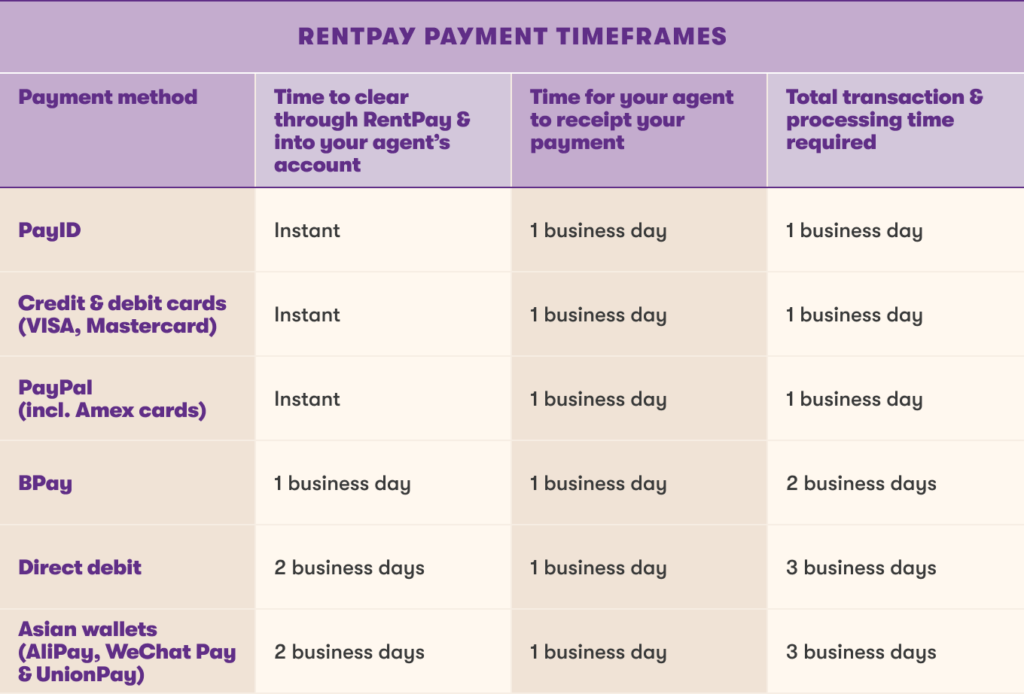

Depending on the payment method you'll be using to pay your rent, it's important to understand how long your payments will take to process and then be received by your landlord or property manager.

You may not realise that there's a lag between when you make your rent payment in RentPay and when it's received into your agent's account on the due date. These are standard transaction processing times required by banking and financial institutions.

The timing varies across payment types, from instantly up to two business days:

Your agent will then take a further day to mark your payment as received or paid ('receipted' in property management terms) in their agency's record management system. However, when your agent sends you your payment receipt on the same day, your payment will be backdated to the previous day (i.e. the day your rent was due).

Be aware that if you contact your agent to check whether they've received your payment, your agent won't know about your payment until they've checked through all the previous day's payments (the day after your payment was paid into their account. You don't have to worry about your agent receipting your payment the day after the due date, but we've mentioned it here so you know what to expect.

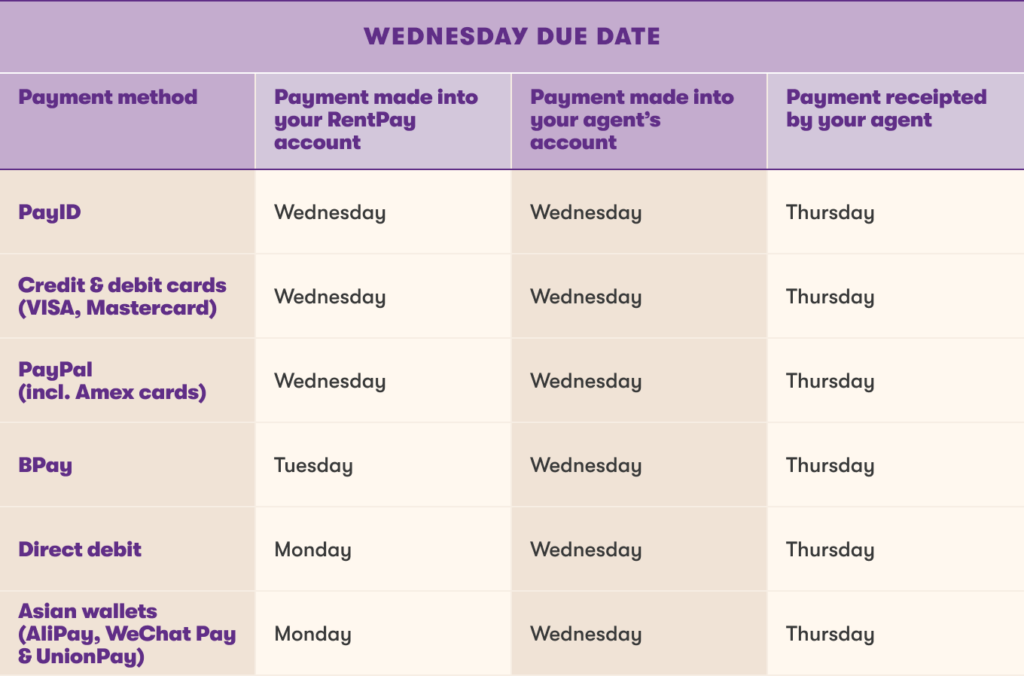

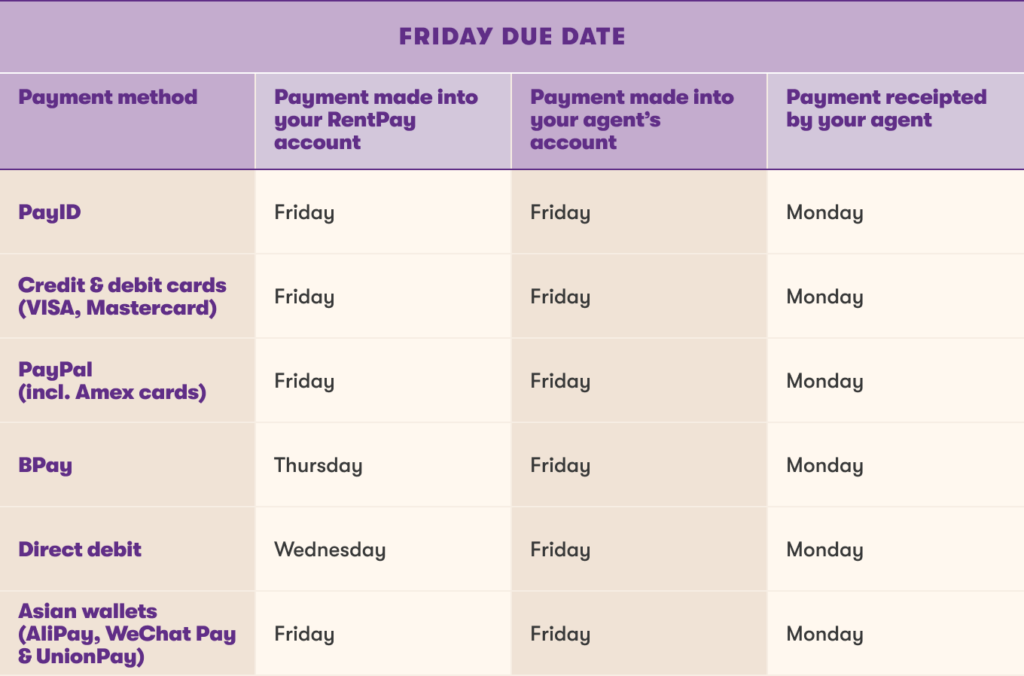

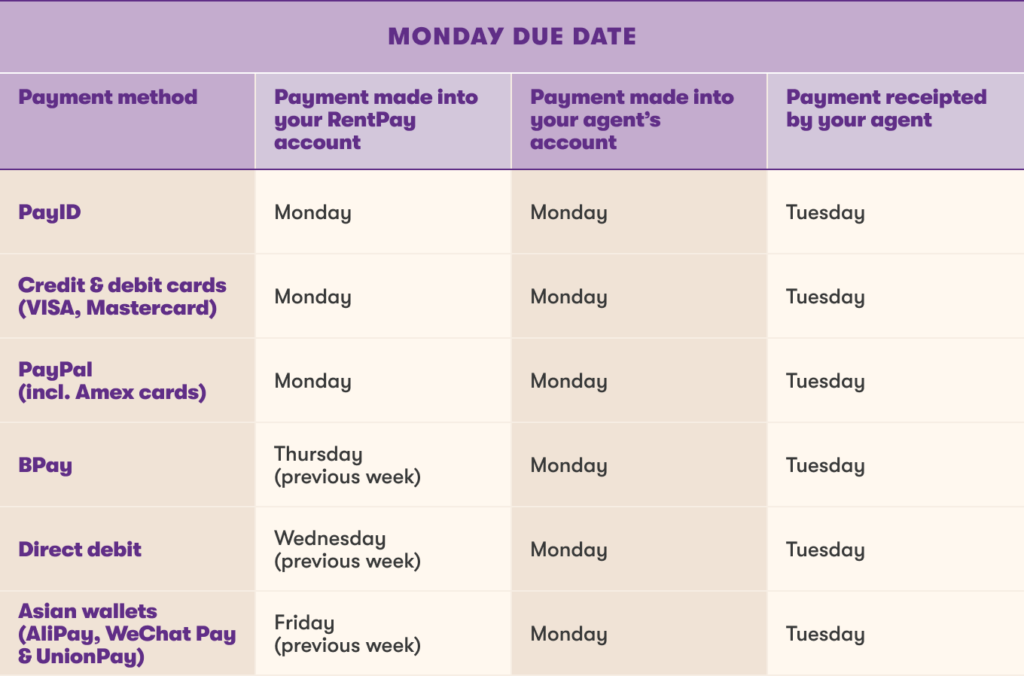

The table below shows the time it takes for your rent payment to clear through the RentPay platform and paid to your agent on the due date, before your agent recognises your payment and sends you the payment receipt.

Important note: The first ‘business day’ is counted as the first recognised working day following the day you’ve made your payment. Weekends and public holidays aren't considered business days, so be mindful that these will impact when your rent payment is received.

To help you decide when to make or schedule your rent payments in RentPay, we’ve provided some scenarios for you below, given there are no public holidays:

If you're unsure about how to set the right payment schedule to ensure your rent's paid on time through RentPay, please contact our customer service team on 1300 797 933 or support@rentpay.com.au.

Top tip: If you're undecided which RentPay payment method is right for you, we've set out the pros and cons for you to consider.

If you have a regular, predictable salary, it's much easier to set and forget your rent payments. That's because you know exactly when you'll get paid and how much will be in every paycheck. This makes deciding which dates to make a payment or knowing what payment schedule to set simpler to work out.

However, if you're a part-time or casual worker, your paycheck may fluctuate and this can impact your rent payments. If you have insufficient funds in your account at the time a rent payment is made, you'll be in rent arrears (shudder) and may be hit with late or unsuccessful transaction fees, or worse.

Having a variable paycheck doesn't mean that you can't set an automated schedule. However, you should probably set reminders to check ahead of your rent due date that you have enough funds in your account to cover the full rent payment.

Alternatively, you can add extra payments to go into your RentPay buffer, ensuring that have a full rent payment sitting in your account ready to help you make rent on time for whenever you might be a bit strapped for cash.

Top tip: Once your RentPay buffer has been depleted, make sure you start making additional payments again to build up to another full rent payment for future use. You can also hack RentPay's buffer feature to stash away savings, set up an emergency fund, or reward yourself with a 'rent-free' Christmas!

Once you have visibility and a good grasp of your paychecks and transaction processing times, you can accurately anticipate when you need to make your rent payments.

If you prefer to make once-off or manual payments, create reminders on your calendar ahead of the rent due dates.

If you choose set-and-forget convenience, set up an automated payment schedule in your RentPay account. This schedule can be easily adjusted at any time.

For those with variable income or want to have a buffer in their RentPay account for 'rainy days', the additional payment account can also either be made manually or automated on a schedule!

Top tip: In addition to automating your rent payments with RentPay, did you know that there are other things you can automate too?

Your work situation could change, whether you vary your work hours, get promoted, or switch jobs. Rental arrangements can change across the term of your tenancy. Your personal life and life in general changes all the time—both planned and unexpected—so you have to be ready for anything!

If your personal, financial or rental situation changes in any way, it's a good idea to review the timing of your rent payments or automated payment schedule.

Given the changes in your circumstances, your existing RentPay arrangement and settings may no longer be suitable. If so, make the necessary adjustments to ensure a smooth transition and avoid rent arrears.

Top tip: If adjusting your rent due dates would work better for you, or maybe you're experiencing some financial hardship, contact your landlord or property manager immediately to discuss arrangements.

You might also like:

> Pay rent your way: Choosing your preferred payment method

> RentPay launches PayPal for rent payments

> How to ace your RentPay game