While traditional metrics like Properties Under Management and Average Annual Management Income are crucial in valuing a rent roll, qualitative factors such as reputation, geographic spread, and the transition process play a significant role in determining its true value.

RentPay General Manager, Shane Lavagna-Slater, says that while traditional metrics are important, they need to be analysed in conjunction with a host of qualitative factors that either add to, or detract from, a rent roll’s value.

“Factors such as the reputation of the current property manager, the geographic spread of properties, type and quality of properties, and landlord concentration all affect the likely ongoing management cost and risk of managing the rent roll,” Shane says.

“Purchasers should also assess the rent roll transition period and process as a factor that impacts the transaction’s value.”

Purchasers could easily overlook the complexity and difficulty of transitioning a rent roll to the new property management business, especially if the purchaser is an existing property management business.

The transition process should be added to the list of considerations a buyer needs to contemplate as this directly affects the future value of the asset they are buying.

The income from the rent roll asset and the risks associated with it needs to be balanced by the ease of transition between seller and buyer.

RentPay offers a unique value proposition for the owners of rent rolls who are preparing or considering selling their rent roll in the future.

The transition of rent rolls can be a notoriously messy endeavour for both the seller and purchaser.

The traditional approach is for a seller to use a rent roll broker to market their rent roll to prospective purchasers, after the due diligence process – a price is agreed, and a sale contract signed.

After settlement has occurred, things can get really disorganised, costing time and effort to get right.

A comprehensive communication campaign and change management plan needs to occur between property managers, renters, and landlords, with the goal of moving rent payments into a new trust account or using a new payment system or method.

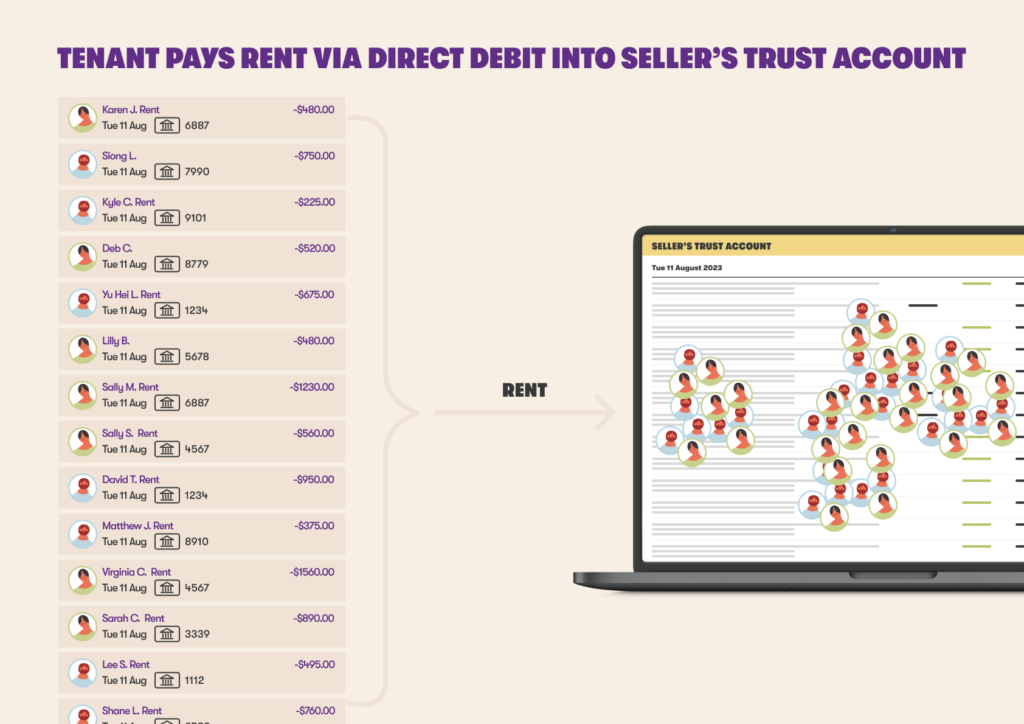

The above visual represents the typical approach of how tenants all pay into a seller’s trust account.

“The value of the rent roll for the purchaser is ultimately in retaining all the purchased properties under management,” Shane says.

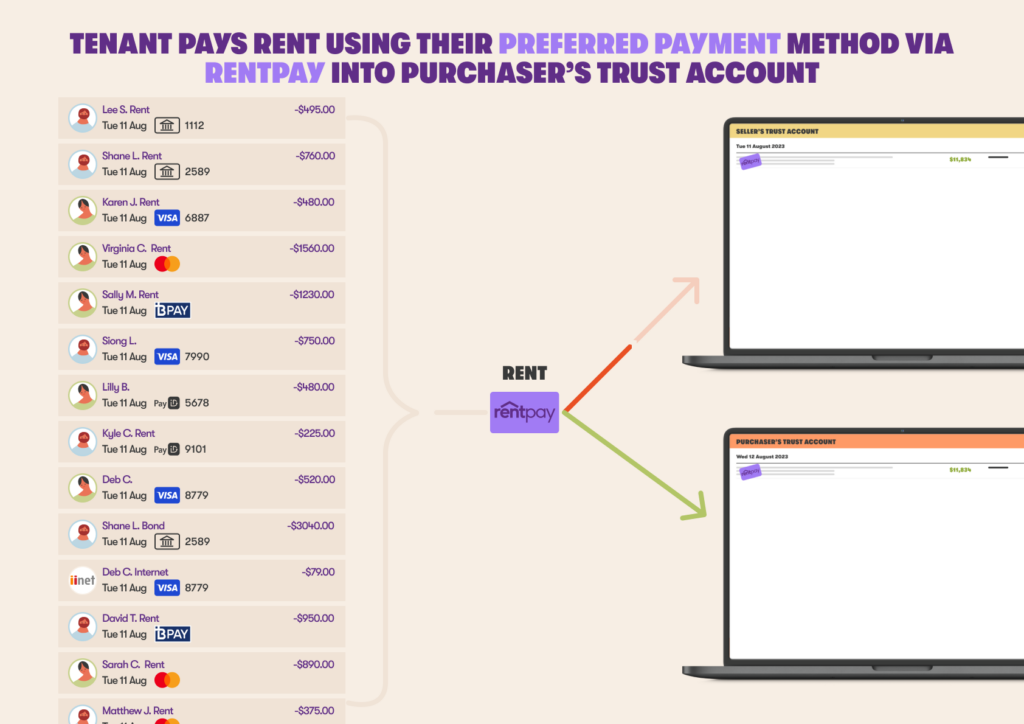

“The post settlement transition period is one of turbulence and confusion since tenants are often slow to change payment details, resulting in the seller receiving funds in their trust account that shouldn’t be there and having to reconcile to the purchasers’ trust account.

“This takes time and often results in tenants being flagged as ‘in-arrears’ and landlords receiving late payments.

“An unwanted scenario when this is the first impression of the new property manager and a nightmare scenario if the purchaser loses properties under management.”

Shane says landlords may also use the rent roll sale as an opportunity to shop around for a new property manager and any issues in the transition process will agitate this.

“This is a potential value destruction event for the rent roll purchaser since portfolio retention is at risk,” he says.

“Success and value for a rent roll purchaser lies in retention of the existing portfolio.”

Shane says RentPay has played a critical part in rent roll sales over the years, simplifying the process for tenants, who don’t have to do anything when a sale occurs.

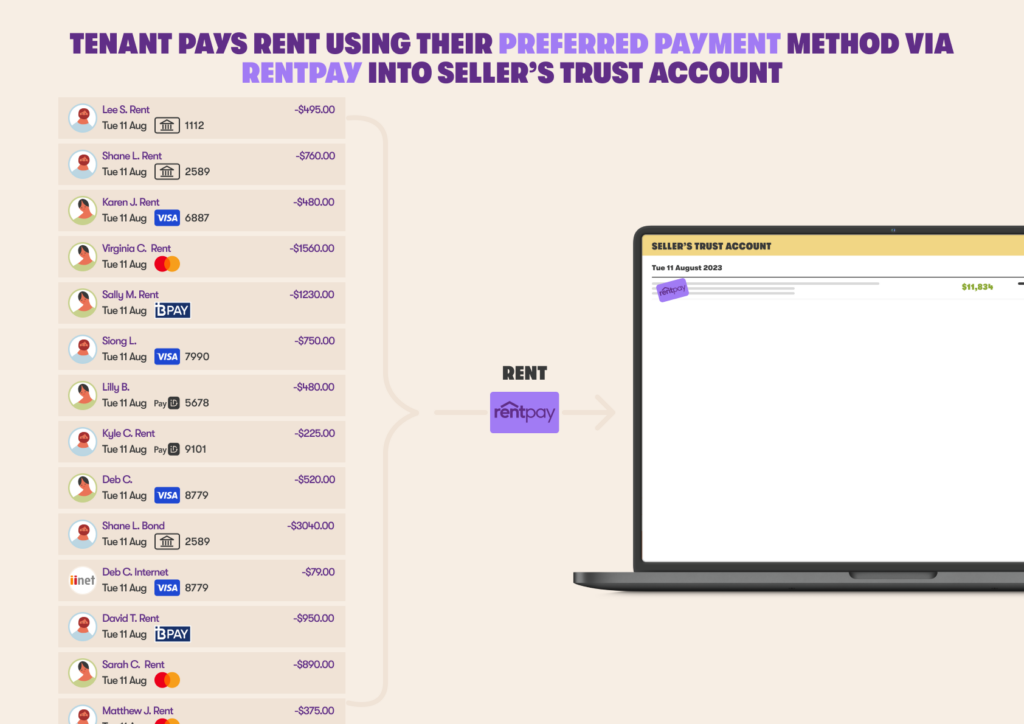

He says RentPay is a payment gateway that offers renters flexibility in how they pay their rent.

Renters can sync rent payments to their pay day, and choose to pay via BPay, PayID, Direct Debit, Credit Card, Alipay, WeChat Pay and Union Pay.

Funds are cleared through RentPay’s payment gateway and processed using its scheduling logic.

This logic determines which agency to pay, how much and when.

Most importantly, RentPay makes a single daily batch payment to property managers at 17:30 AEST of cleared funds, which means there are no dishonours or clawbacks of funds.

“On settlement date of the rent roll transaction, all that needs to be done is to provide confirmation to RentPay and there is simply a change where the rent is paid by RentPay,” Shane says.

“The purchaser starts receiving the single daily rent payments from that point onwards.

“The tenant doesn’t need to be disturbed, the flow of rent continues uninterrupted, and the changeover is orderly, easy, and uncomplicated.”

BusinessDEPOT Agency Broking Director, Brad Dean, notes that while many things influence the sale multiple of a rent roll, the improved management efficiency RentPay provides is an attractive factor.

“In a sale transaction, anything that will ease the administrative burden of the transfer process is a good thing and may result in less retention loss, providing greater certainty for the buyer and more realised cash for the seller upon completion,” Brad says.

Such a carefully planned transition enables the purchaser to take full control of the transition process, which allows them to present themselves professionally to their new landlords and tenants.

Shane says where RentPay has been involved in moving rent rolls to new property managers, phenomenal results have been achieved for the sellers and the purchasers.

Rent.com.au Chief Financial Officer, Jan Ferreira, says it’s a win-win scenario for sellers and purchasers.

“In addition to the ‘normal’ factors that go into pricing rent rolls, it’s now also necessary to add a premium based on how renters pay their rent,” Jan says.

“Not only does RentPay save you time and money while you’re managing the rent roll, it can also deliver extra value when the time comes to sell that rent roll.

“The best results have been achieved by property managers who have their entire rent roll using RentPay.

“Existing property managers on RentPay have achieved this by subsidising the flat $2 monthly per user fee to use RentPay, thereby making it free for renters to use.

“To put this into perspective, on a 100-property rent roll, this subsidy would cost $200 per month, but could improve the rent roll multiple.

“Even if the increase in the multiple is from 3 to 3.1, it’s well worth it and moving your entire rent roll across to use RentPay can be achieved within weeks.”

Shane says once renters start using RentPay, they soon discover the rewards and cashbacks available within RentPay that make it such an attractive and compelling offering.

In fact, some 20% of all RentPay users sign up to use RentPay, even when their agent uses other payment solutions, to access its features and take advantage of its benefits.

RentPay currently has thousands of renters and hundreds of real estate agencies across Australia using the service, with no lock-in contracts.

The last 12 months has seen exceptional growth for RentPay:

If you’re interested in setting up your business to command a potentially higher premium, faster transition, and smoother settlement then Shane Lavagna-Slater would love to have a chat.

Setting your agency up on RentPay and moving an entire rent roll across to use RentPay can be achieved within a few weeks.

How does getting a better credit score sound just by paying your rent on time sound?

You might also like:

> New feature: Rental adjustments

> Tenancy invoicing and bill payments