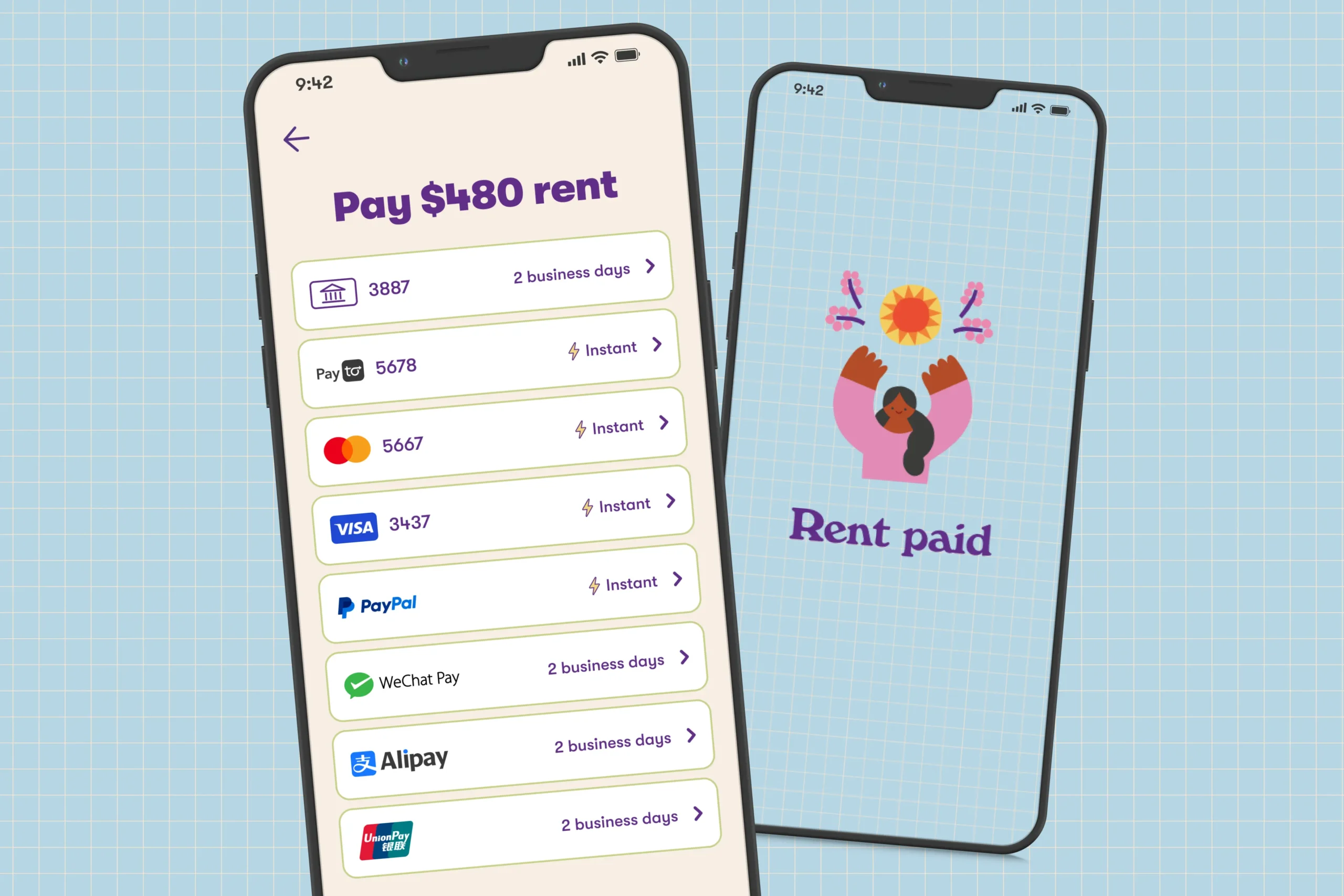

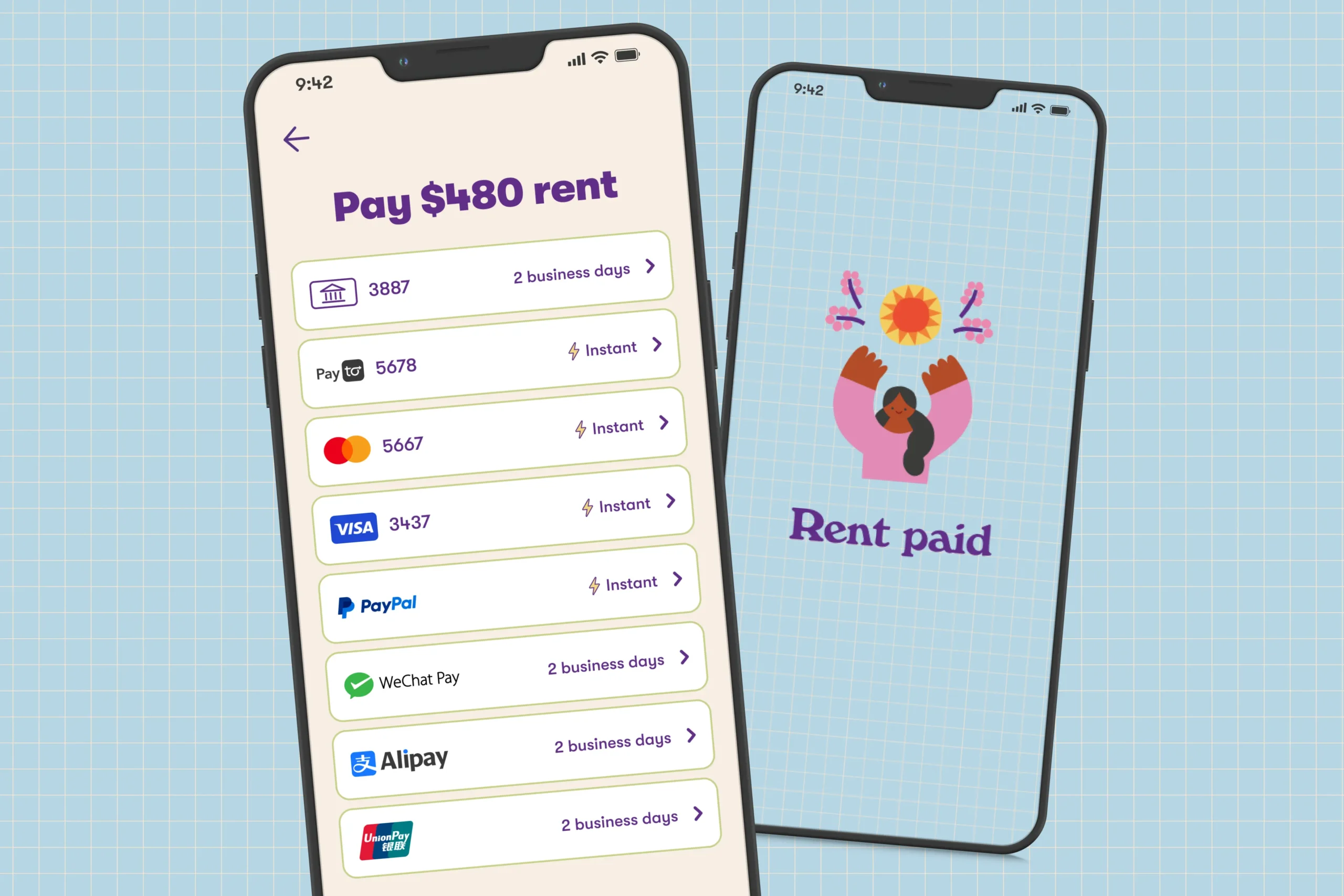

RentPay offers the widest range of convenient and safe payment methods for renters in Australia to pay rent, bond and other tenancy-related bills through our user-friendly online platform.

While having the choice from an extensive menu of options is a good problem to have, it can be a bit confusing for some to decide on which one to pick.

In this article, we walk you through the suite of payments options available in the RentPay platform and provide a brief overview of each to help you decide which one might be the right one for you.

You can link and add more than one payment method in your RentPay account. This gives flexibility for helping you to manage your cash flow, make an instant or one-off payment, and more.

Important note: It's completely your choice to decide which is your preferred payment method. While we've provide some brief information on the available payment options, please ensure you do your own research and/or seek advice to understand these options before making a decision.

Who it's for: Everyone who has a bank account will be familiar with transferring money from their bank account to a recipient. The manual direct debit option is available for people who prefer full control over the amount and timing of their payments.

Funding into RentPay wallet: Manual only.

Payments to property manager: Manual only.

How it works: This is a free and simple way which allows you to add funds into your RentPay wallet via a manual direct debit, before the funds can then be paid to your property manager.

To set up, link the direct debit payment method in your RentPay account when you onboard (or add this option later) and enter your bank account details. When you need to make a rent or tenancy-related bill payment, click on the pay button in your RentPay account and choose the direct debit option in the ‘make a one-off payment’ selection. Once funds have been received in your RentPay wallet, you'll then need to log into your RentPay account to release these funds to your property manager.

As this is a manual payment, please ensure that you pay with sufficient time for funds to clear to avoid a late rent payment.

Pros: Familiarity, ease of use, no transaction fee.

Cons: Funds take up to two business day to clear, may incur a dishonour fee for insufficient funds, manual payment requires more effort and discipline to ensure rent is paid on time.

Who it's for: Most people are already very used to payments being conveniently directly debited from their bank account at a specific date once setup has been completed. It's a reliable payment method that can be expected like clockwork, ensuring payments will always be made on time (given there are sufficient funds in your bank account).

Direct debit is by far the most popular option in the RentPay platform.

Funding into RentPay wallet: Automated only (set on a recurring schedule).

Payments to property manager: Automated only (set on a recurring schedule).

How it works: Funds are automatically debited from your bank account, then released to your property manager after these funds have been received in your RentPay wallet.

To set up, link the direct debit payment method in your RentPay account when you onboard (or add this option later), enter your bank account details, and then set your preferred payment schedule. Your payments will be debited from your bank account according to the recurring schedule you've set in your RentPay account. Once funds have been received in your RentPay wallet, these funds will be automatically paid to your property manager.

Your payment schedule can be adjusted at any time in your RentPay account.

Pros: Familiarity, ease of use, ability to set up automated/recurring payment schedule, set and forget convenience ensuring rent is always paid on time.

Cons: Funds take two business days to clear, may incur a transaction fee, may incur a dishonour fee for insufficient funds.

Who it's for: Most people will have used BPAY before to pay a bill via their internet banking portal, so for some this is their preferred method to pay household and utility bills. The funds also clear faster than the direct debit payment option.

Funding into RentPay wallet: Manual only.

Payments to property manager: Manual or automated (set on a recurring schedule).

How it works: This is a simple way which allows you to add funds into your RentPay wallet via BPAY, before the funds can then be paid to your property manager.

To get started, log into your internet banking portal, select the BPAY option, and add RentPay's biller code plus your unique reference number. After RentPay has been set up in your internet banking portal as a biller, the details can be saved to streamline future payments. Once funds have been received in your RentPay wallet via BPAY, these funds will be automatically paid to your property manager if you’ve set a payment schedule in your RentPay account. If you haven’t set a recurring schedule, you'll need to click on the pay button in your RentPay account and choose ‘make a one-off payment’ to pay your property manager using the funds received in your wallet.

As this is a manual payment, please ensure that you pay with sufficient time for funds to clear to avoid a late rent payment.

Pros: Familiarity, ease of use, keeps personal banking details private, biller code can be set up in internet banking portal.

Cons: Funds take 4–6 business hours to clear, incurs a transaction fee, manual payment requires more effort and discipline to ensure rent is paid on time.

Who it's for: PayID is a more recent and increasingly popular way to send from, and receive funds into, your bank account. A key benefit of PayID is the ability to transfer and accept funds instantly with your bank account through a unique payee identifier, like a phone number or email address.

Funding into RentPay wallet: Manual only.

Payments to property manager: Manual or automated (set on a recurring schedule).

How it works: This is a simple way which allows you to add funds into your RentPay wallet via PayID, before the funds can then be paid to your property manager.

To get started, log into your internet banking portal, select the PayID option, and use RentPay's specified email address as the unique identifier. Once funds have been received in your RentPay wallet via PayID, these funds will be automatically paid to your property manager if you’ve set a payment schedule in your RentPay account. If you haven’t set a recurring schedule, click on the pay button in your RentPay account and choose ‘make a one-off payment’ to pay your property manager using the funds received in your wallet.

As this is a manual payment, please ensure that you pay on time to avoid a late rent payment.

Pros: Familiarity, ease of use, instant clearing of funds, keeps personal banking details private.

Cons: May incurs a transaction fee, manual payment requires more effort and discipline to ensure rent is paid on time.

Who it's for: Most transaction bank accounts come with a debit card for withdrawing cash and making purchases – they're particularly useful when buying online. People may choose to have a credit card to help manage their budgets and cash flow by paying via credit card, and then paying off the balance each month. Those with points-earning credit cards may choose to make rent payments via credit card to boost rewards/frequent flyer points.

Debit and credit cards are another popular option on the RentPay platform.

Funding into RentPay wallet: Manual or automated (set on a recurring schedule).

Payments to property manager: Manual or automated (set on a recurring schedule).

How it works: Funds can be manually or automatically debited from your debit or credit card, which are then released to your property manager from your RentPay account. This payment option in the RentPay platform accepts Mastercard and Visa.

To set up, link the debit or credit card payment method in your RentPay account when you onboard (or add this option later), and then enter your card details. Your card details will be saved in your account to streamline future payments. If you’ve set a payment schedule in your RentPay account, your funds will be automatically debited from your nominated card, and RentPay will release these funds to your property manager. If you haven't set a recurring schedule, click on the pay button in your RentPay account and choose the debit or credit card option in the ‘make a one-off payment’ selection.

Your payment schedule can be adjusted at any time in your RentPay account.

For those without a payment schedule, please ensure that you pay on time to avoid a late rent payment.

Pros: Familiarity, ease of use, instant clearing of funds, keeps personal banking details private, fraud protection, lowest credit card transaction fees in the market, ability to earn reward/frequent flyer points when paying via a points-earning credit card, ability to set up automated/recurring payment schedule.

Cons: Incurs a transaction fee, credit cards should be used responsibly to avoid going into debt, manual payment requires more effort and discipline to ensure rent is paid on time.

Who it's for: If you're someone who prefers to avoid sharing your personal banking details, or having to re-enter your financial details every time you make an online purchase, then you probably have a PayPal account.

American Express credit card holders can make rent payments in the RentPay platform via the PayPal option as a way to supercharge rewards/frequent flyer points.

PayPal also gives international renters (expats, migrants, students and workers) the ability to easily and safely pay their rent in Australia using international funds. PayPal accepts overseas funds from any approved bank, card or digital wallet from 200+ countries and in 25+ currencies.

Funding into RentPay wallet: Manual or automated (set on a recurring schedule).

Payments to property manager: Manual or automated (set on a recurring schedule).

How it works: Funds can be manually or automatically debited from your PayPal account, which are then released to your property manager from your RentPay account.

To set up, link the PayPal payment method in your RentPay account when you onboard (or add this option later), and then enter your PayPal account details. Your PayPal details will be saved in your account to streamline future payments. If you’ve set a payment schedule in your RentPay account, your funds will be automatically debited from your PayPal account, and RentPay will release these funds to your property manager. If you haven't set a recurring schedule, click on the pay button in your RentPay account and choose the PayPal option in the ‘make a one-off payment’ selection.

Your payment schedule can be adjusted at any time in your RentPay account.

For those without a payment schedule, please ensure that you pay on time to avoid a late rent payment.

Pros: Familiarity, ease of use, instant clearing of funds, keeps personal banking details private, fraud protection, enables American Express credit card payments and earning rewards/frequent flyer points, global coverage for international funds accepted, ability to set up automated/recurring payment schedule.

Cons: Requires user to have a PayPal account, incurs a transaction fee, manual payment requires more effort and discipline to ensure rent is paid on time.

Who it's for: Chinese expats, migrants and students might not have opened an Australian bank account – by choice or having newly arrived – or instead choose to keep their funds overseas. Having previously used Alipay, WeChat Pay and UnionPay in their home countries, this payment method offers a more familiar payment option for Chinese renters in Australia.

Funding into RentPay wallet: Manual only.

Payments to property manager: Manual or automated (set on a recurring schedule).

How it works: This is a simple way which allows you to add funds into your RentPay wallet via Alipay, WeChat Pay or UnionPay, before the funds can then be paid to your property manager.

When you need to make a rent or tenancy-related bill payment, click on the pay button in your RentPay account and choose the Asian wallets option in the ‘top up my RentPay account’ selection. You'll be able to access your Asian wallet here to complete the payment. These funds will be automatically paid to your property manager if you’ve set a payment schedule in your RentPay account. If you haven’t set a recurring schedule, click on the pay button in your RentPay account and choose ‘make a one-off payment’ to pay your property manager using the funds received in your wallet.

As this is a manual payment, please ensure that you pay with sufficient time for funds to clear to avoid a late rent payment.

Pros: Familiarity, ease of use, accepts overseas funds from popular Asian wallets.

Cons: Funds take two business days to clear, keeps personal banking details private, may incur higher transaction fees than other payment methods, manual payment requires more effort and discipline to ensure rent is paid on time.

| Payment Method | Transaction Fee |

|---|---|

| Direct Debit (manual) | Free |

| Direct Debit (automatic) | $0.85*^ |

| PayID | $1.00*^ |

| BPAY | $1.00 |

| Debit/Credit Card (Mastercard/Visa) | 0.99% |

| PayPal (including AMEX) | 1.55% |

| WeChat Pay and Alipay | 1.50% |

| Union Pay | 2.20% |

* For customers joining RentPay directly, Direct Debit and PayID costs are included as they've been bundled into the $2 monthly subscription.

^ If you've been invited by your Property Manager to join RentPay, they may choose to subsidise Direct Debit and PayID on your behalf. Your onboarding email will explain the fees in detail.

You might also like:

> What is PayID and how does it work?

> RentPay launches PayPal for rent payments

> Cross-border payments with Asian wallets