In an Australian first, RentPay has partnered with PayPal to provide global coverage and additional options for rent payments.

We're thrilled to launch this game-changing ‘first in market’ feature, which offers even more convenience, flexibility and choice for Aussie renters using RentPay as their rental payment platform.

PayPal is an exciting addition to the already extensive menu of payment methods within the RentPay platform. Our users can now use their PayPal account and linked payment details to make manual payments or set up a recurring rental payment schedule.

The key benefits of this new partnership for RentPay users are the expanded payment options available to suit everyone’s individual circumstances, needs and preferences. This includes accepting international funding from more countries, and the ability to take advantage of points-earning credit cards.

RentPay is continually innovating at the forefront of the payments industry, offering safe and seamless local and cross-border payment solutions.

RentPay’s partnership with PayPal complements our existing suite of Australian and Asia-Pacific payment options, now enabling us to provide full global coverage for rent payment methods.

Why is this so groundbreaking? PayPal is available in 200+ countries and has 400+ million active customers. In Australia alone, there are millions of PayPal users.

Alongside our already existing international wallets like AliPay, WeChat Pay and UnionPay, the addition of PayPal means that RentPay can accept payments from anywhere in the world via an approved bank, card or digital wallet – with the added benefit of not needing to share any personal financial details.

PayPal’s worldwide coverage solves a real issue for many international renters living in Australia, to easily allow international funds from existing accounts in their country of origin to be used for rent payments.

For example, newly arrived expats to Australia and international students and migrants now have instant access to overseas funds for paying their rent.

RentPay users can add PayPal from the list of displayed payment methods, triggering a secure authorisation process with PayPal. Once completed, deposits can be made from PayPal into the user’s RentPay account manually or using their preferred deposit schedule.

Funding into the user’s RentPay wallet will come from whichever payment method they’ve set up with PayPal. All rent, bond and utility payments are then disbursed in Australian dollars to their real estate agency’s trust account.

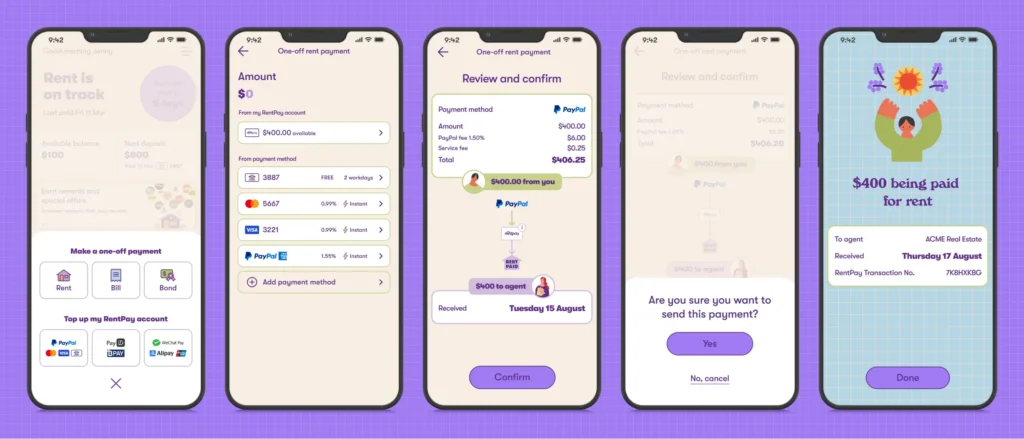

Making a once-off or ad hoc payment in RentPay using PayPal is a simple and straight forward process.

To make a payment via PayPal, select the manual payment option in the RentPay app or web home screen. Select the amount you’d like to pay via PayPal, confirm and it’s done.

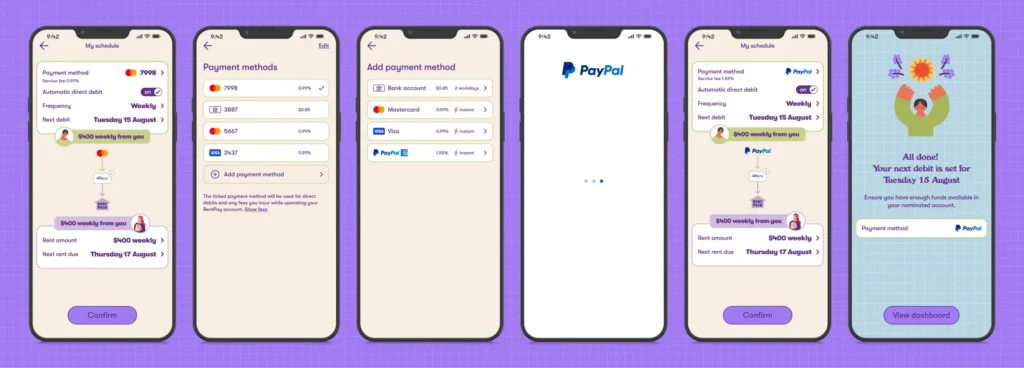

Setting up a recurring rent payment is just as easy and seamless as making a manual payment, but the benefit is saving time with set-and-forget payments.

Once a RentPay user has set up their rent schedule, they’ll add in the PayPal payment method by confirming and linking their PayPal account. When the payment method has been successfully linked, users can confirm their ongoing rent payments to be made via their PayPal account.

RentPay is a safe, simple-to-use rental payment platform and digital wallet that transforms how you pay rent, bond and utilities, and makes your rent money work harder for you.

Nationally, we’re making life easier for thousands of Aussie renters and hundreds of real estate agencies.

Our user-friendly app offers a raft of features and benefits designed to help you get ahead during your renting journey. Read some tips on how to get the most out of using RentPay.

Find out more by visiting the RentPay website, or chat with our local customer service team on 1300 797 933.

If you’re ready to get started, it only takes a few minutes to join RentPay – there are no lock-in contracts, and you can cancel your account whenever you no longer need it.

You might also like:

> Pay rent safely with RentPay

> Pay rent your way: Choosing your preferred payment method

> How to ace your RentPay game