At Rent.com.au, we believe you deserve more perks and privileges for being a good renter, and we're building the technology to do just that.

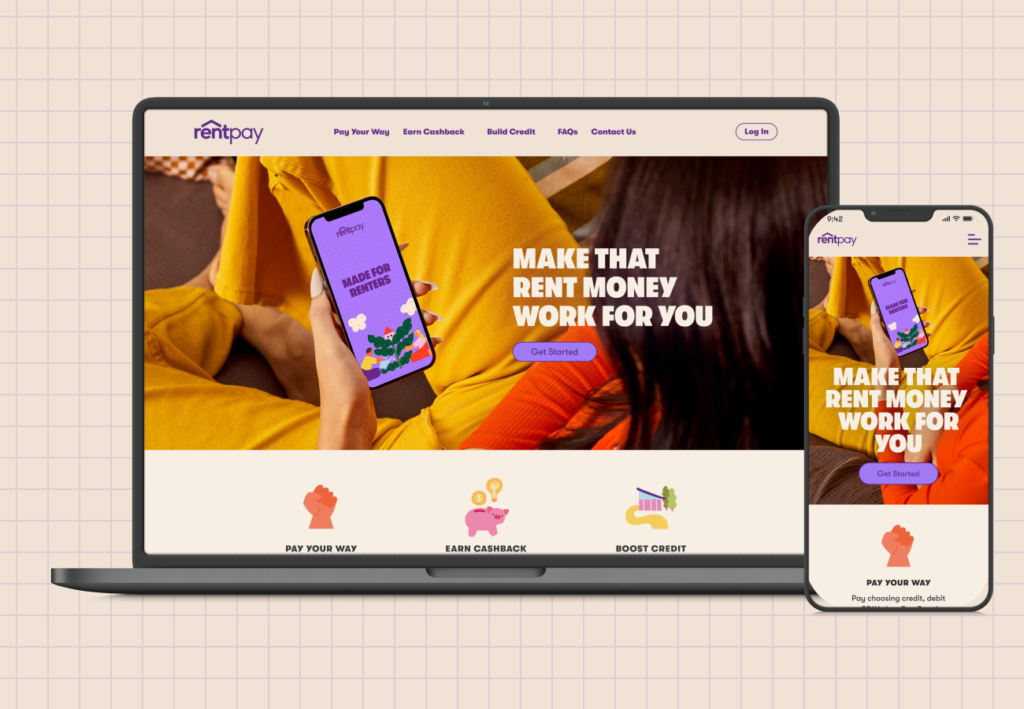

We developed RentPay by listening to the 700,000 renters who visit Rent.com.au each month. Check it out, and see if you like it. It's all part of our mission to enable and empower Australia's renters.

Happy renting!

Whether you're a first-timer or a seasoned renter, RentPay can make your rent money work harder for you:

You can get started by either downloading the RentPay app (App Store or Google Play) or sign up online. The app will step you through the set-up process, which you only need to do once.

You might also like:

> Pay rent your way: Choosing your preferred payment method

> Point hacking: Earn rewards by paying your rent with a credit card on RentPay

> Boost your credit score with RentPay's Scorebuilder

RentPay comes with a digital wallet, where we'll store your funds, ready to pay the rent. When you set up RentPay, we'll ask you how and when to pay funds into your wallet. We'll also ask you when you want us to transfer the rent to your property manager.

We suggest you set up automated rent payments. This means you'll provide us with the amount and frequency of your rental payments. From there, we'll make the payment based on your instructions. If you prefer, you can make a manual payment too.

Regardless of your property manager's preferred payment method, RentPay has you covered. We'll pay directly into their bank account, so from your agent's point of view, they'll see your rent being paid with your payment reference information attached.

If you're unsure of your agent's information (such as their bank details), check your lease agreement or contact them directly to confirm the correct details before you start.

You might also like:

> Save money with Paylab shopping rewards

> RentPay launches PayPal for rent payments

> Cross-border payments with Asian wallets