In today's ultra-competitive rental market, your reliable payment history's a big deal, especially when your rent is usually your single biggest expense each week. When you're doing everything right, and paying your rent on time, don't you think you deserve to be rewarded?

The time you spend renting – and always staying up-to-date on top of your rent – should count for something. At RentPay, we believe that you should be rewarded by being in a better financial position at the end of your time renting and part of that is your credit score. A critical component of moving from renting into home ownership is applying for a mortgage, where your credit score has a big influence.

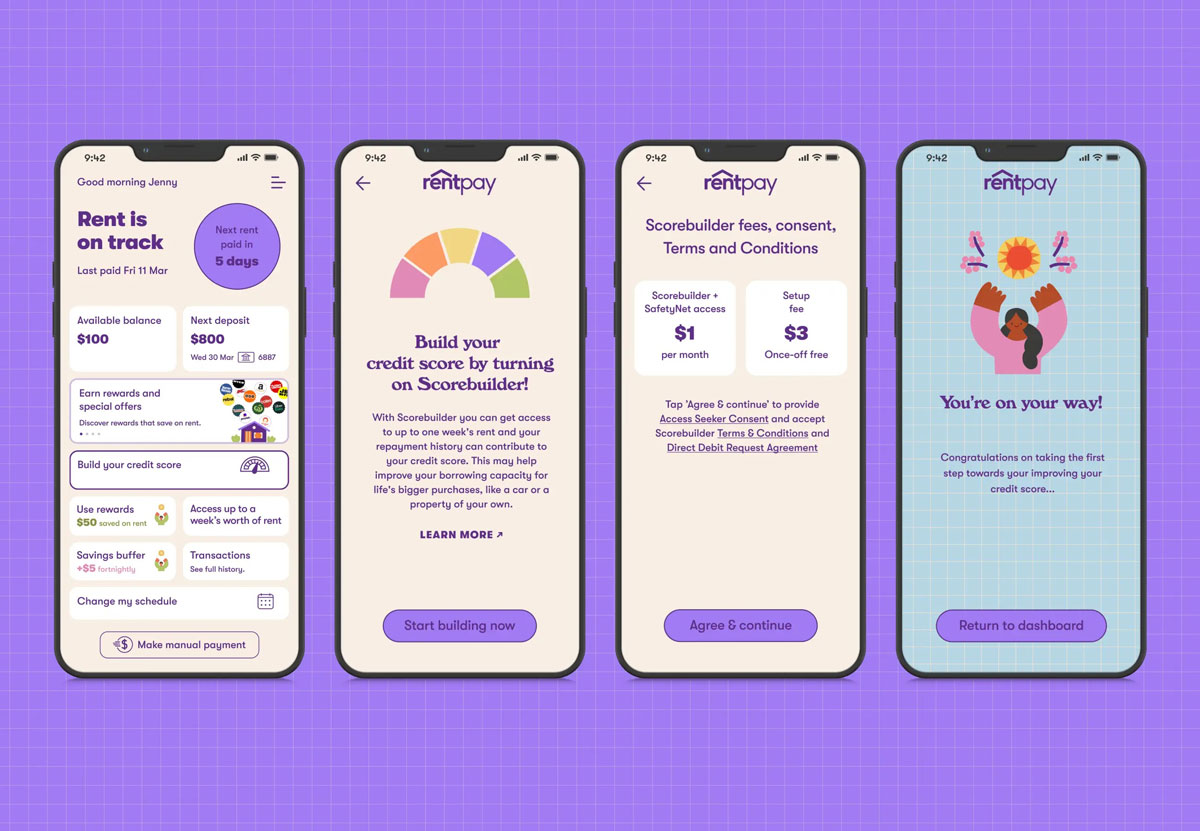

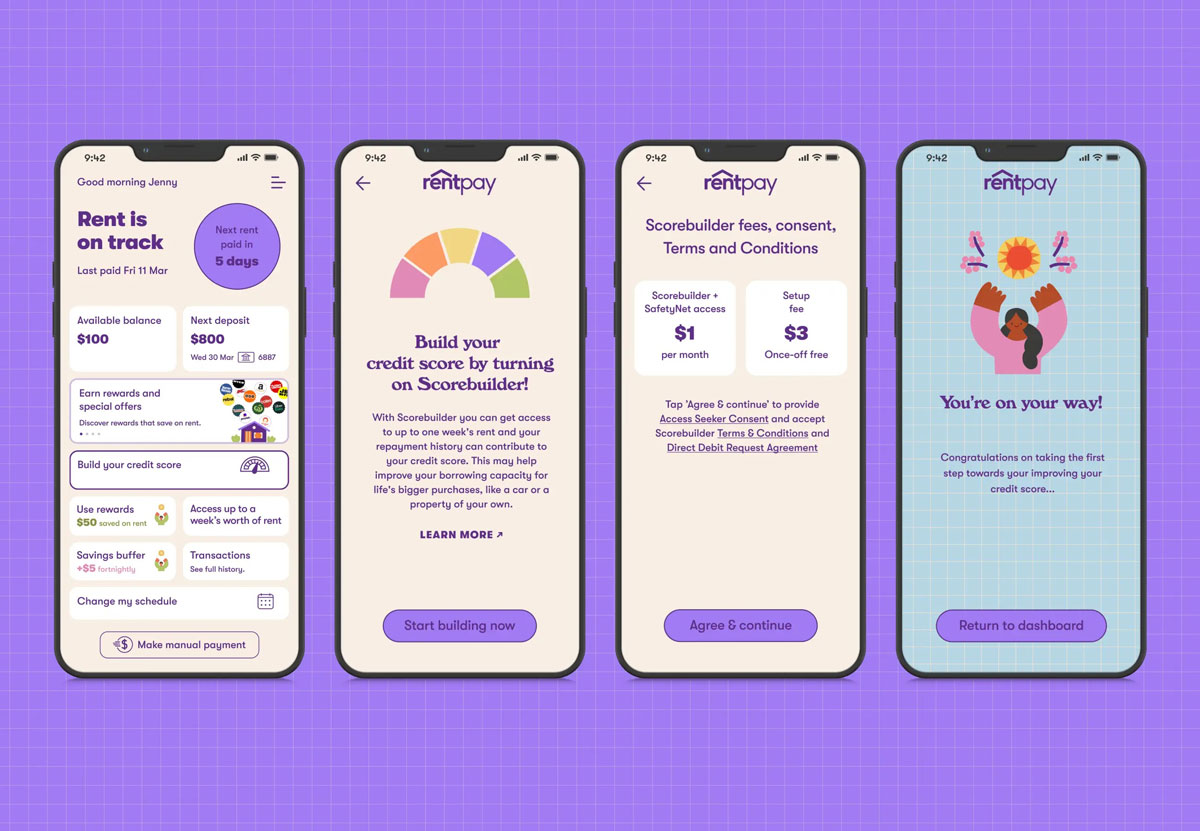

That's why we built Scorebuilder as an optional feature in RentPay which can boost your credit score.

How does getting a better credit score sound just by paying your rent on time sound?

By activating Scorebuilder, you can access an interest-free line of credit for up to one week's worth of rent.

If your credit score is very low or damaged (we get it, it happens), Scorebuilder can help improve your standing by using your first three months of good conduct to qualify for a line of credit. Sorted.

Scorebuilder is usually available to RentPay subscribers after a qualifying period of good conduct while using our rental payment platform. This is important as it shows you're doing the right thing and staying on top of your rent payments.

This line of credit will appear on your Equifax credit file listed as 'One Card Credit', the issuing facility.

Each month you have the Scorebuilder feature active, we report your account status to Equifax which, over time, could help to boost your credit score.

The impact of Scorebuilder on your credit score will depend on various factors, including other credit facilities you may have outside of RentPay that can also impact your score, such as credit card or loan repayments.

The impact of Scorebuilder on your credit score will depend on various factors, including other credit facilities you may have outside of RentPay that can also impact your score, such as credit card or loan repayments.

Most important is how you use Scorebuilder, having an open and up-to-date (fully paid) line of credit should contribute favourably to your credit score.

Log into RentPay and follow the prompts from the dashboard to opt into Scorebuilder.

Have questions? The RentPay customer service team is ready to help. Call 1300 797 933 or send us an email.

You might also like:

> Common renting myths about money

> Creating a financial plan: How to set goals and achieve financial wellness while renting

> Save money with Paylab shopping rewards